A short letter in the AFR this morning by Fred Argy (here) argues that, while the Howard government is getting credit for the strong performance of the economy over the last decade, the contribution of the Reserve Bank of Australia also needs recognition. The Howard government have employed prudent fiscal policies and developed some marginally useful reforms such as the GST. They have also benefited from a strengthening of the terms of trade, reaped the benefits of prior Hawke-Keating reforms and enjoyed a generally buoyant international economy with low interest rates and low international inflation. But the RBA has also made a strong contribution:

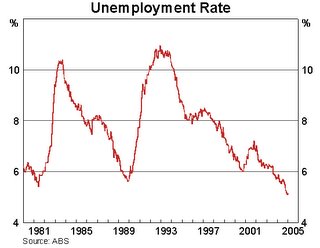

A sensible summing up. The RBA's response, in terms if interest rate policy, to the Asian economic crisis of 1997 and to the ensuing claimed house price bubble has shown skill and capitalised on the advantages of allowing exchange rates to float. A focus on inflation has also led to improved employment outcomes, contrary to the claims of RBA critics. The figure above (for Australia) illustrates this.In the late 1980s and early 1990s, the RBA gradually asserted its independence under governor Bernie Fraser and helped to fundamentally alter inflation psychology. But it was too preoccupied with current account deficits and insufficiently focused on employment and growth.

It also made little use of moral suasion in lieu of interest rate changes to influence markets.

In the past decade, the RBA has been a model central bank on all these counts - certainly far superior to its counterparts in Europe and New Zealand.

1 comment:

Bernie Fraser is the greatest.

It is he that led to inflation remaining low and not increasing agian to high levels sch as in 1983.

Super-Mac has continued that.

Let us hope that Glen Stevens is appointed to continue the good work.

The RBA has a better track record than the FED

Post a Comment