An environmental economics group last week asked me to analyse the effect of a reduced price of a backstop substitute (such as 'tar sands') on the time path of prices for conventional oil resources. A famous result by Hotelling says that, with enough competition in producing oil at low extraction costs, for oil to be sold gradually rather than kept in the ground or all be extracted immediately, its price must increase at the rate of interest until it hits the choke or 'backstop' price where the oil is no longer ever used. The initial price charged must be such that, when the backstop price gets hit, the oil resource is just completely depleted.

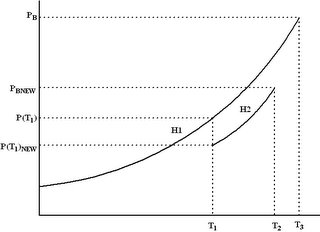

The figure illustrates what theory predicts. Oil prices increase at the interest rate along their Hotelling price trajectory H1. They increase up to PB, the choke price where consumers switch to a backstop at time T3 at fixed price PB. Now suppose at T1 there is a shock lowering the backstop price to PBNEW- this might reflect a technological breakthrough reducing costs of getting oil from, for example, tar sands. The effect is to cause an immediate collapse in current oil prices from P(T1) to P(T2) whereupon a new lower Hotelling price path H2 results with higher use at each time than would have been the case before the shock. The conventional oil resource is depleted at T2, earlier than before.

Thus one way to moderate current oil prices (now around $70 per barrel) is to invest in the efficient provision of backstop supplies.

But will this work? With monopoly power in OPEC I think possibly not. Indeed current oil prices seem to be well-above backstop levels which suggests oil producers should be cutting their prices markedly but they show no sign of doing so. It is important is to recognise that OPEC has price-setting power and may be dealing strategically with alternative energy suppliers. We know that extraction costs of much Middle East oil are low - Saudi Arabia likes to remind us of this - so they can cut prices heavily to maintain their market and still remain viable. What matters to alternative energy suppliers is not the price OPEC charges now but the price they would charge were alternative energy supplies to come on-stream.

It seems to me that this is part of the reason alternative energy supplies are not coming on-stream more rapidly right now (quite a lot is occurring via firms like Shell) to help cope with, what might amount to being, an impending liquid fuels crisis. The fear is that alternative energy suppliers, having incurred high fixed development costs, will always face oil prices set to make sure they are uneconomic. To put it simply, producers of alternative fuels are concerned that oil prices may again dip to levels much lower than current levels.

One way out of these dilemma is for governments to agree to insure the value of competiting fuels by offering to subsidise any gap between average production costs of the alternatives to conventional fuels. Indeed if you attach a high probability to current 'peak oil' hypotheses this is one way of avoiding a sharp discontinuous spike in energy prices as conventional supplies deplete. Publicly-subsidised investment in new production technologies will also increase private sector incentives to innovate.

3 comments:

One of the other problems with alternatives like oil shale, tar sands, gas-to-oil and particularly coal-to-oil (the ones which attract most interest in Australia) is that most of the conversion processes result in emissions of large amounts of CO2, on top of that emitted when they are burned in our vehicles.

Therefore, if a carbon charge comes in in the future, and the conversion emissions aren't sequestered, the production cost of this type of alternative fuel could be much higher than a naive analysis would indicate, though I've not crunched any numbers...

Robert if your claim is correct then that would suggest that socially correct backstop prices are higher than their current marginal costs. If it was understood now they would be taxed in a way that would reflect carbon charges the backstop price would rise - increasing current oil prices and delaying the time it takes to switch to the backstop.

I've heard that coal -> oil is feasible cat $35US and that shale oil and tar sands are exploitable at these prices too hence the question I posed.

BTW I recall shale oil was blocked in Queensland on environmental grounds. I had stock in Central Pacific which went bankrupt so I recall the failure with bitter anguish.

I've heard similar figures: this article was linked from the Wikipedia article on coal.

This number almost certainly doesn't reflect a carbon charge.

I'm not the economist, but your analysis of the consequences seems reasonable - it might also push us towards solutions like algal biofuels which have a higher marginal cost but have smaller or negligible greenhouse impact.

Post a Comment