The last oil boom, from 1973-1985 had several adverse impacts on the world economy. The oil price increase created global stagflation and Arab states, unprepared for their newfound wealth, socked too much away in US Treasuries and international banks. The banks in turn lent it to Latin American governments who couldn't repay triggering a debt crisis that shook the global financial system.

The cover story in Business Week this issue concerns the second Middle East oil boom now occurring but subject to much less analysis. The boom is characterized by a rush of petrodollars creating enormous private and public wealth and reshaping Gulf business and society. This year, with high oil prices, perhaps half a trillion dollars will land in OPEC coffers, more than at any time since the first boom. There are distinctive features of the current boom:

1. Ther coexistence of another Mideast - of Iraq, radical Islam, and Palestinian-Israeli relations - wracked by violence which threatens the Gulf's prosperity. In late February, for example, al Qaeda fighters unsuccessfully attacked a key oil facility in Saudi Arabia. In the worst case, Iraq's troubles could spill into conflicts between Sunni and Shiite Muslims around the region. How US-Arab relations play out will also prove influential in containing potential strife.

2. Unlike the first boom much more money being spent within the Gulf. Local stock markets have risen wildly and imports are soaring.Yet, in contrast to the helter-skelter development of the 1970s, a new and better-planned Middle East economy is rising, shaped by a well-educated business class and powered by a youthful population seeking prosperity.

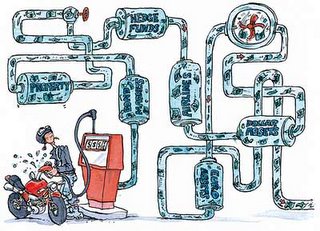

3. There are still sunstantial capital otflows. Billion dollar investments are being made in various international ventures outside the oil area. Investors are currently expanding their private-equity positions rather than putting money into hedge funds . There is also money flowing into US Treasury securities and other passive investments. While official US official government data indicate that OPEC countries held $67 billion in Treasuries as of December - trivial compared with the holdings of China and Japan - Paul Donovan, a global economist for UBS Investment Bank, estimates that petrodollars, channeled through Asia and Europe, are funding up to 45% of the US current account deficit. The Economist (here) does not put a figure on it, but quotes various private sources as assering a key role. There is a claim that high oil prices are providing net benefits to the US economy through the investment of the Gulf states in US dollar denominated assets driving down interest rates.

The US is receiving much criticism over its conduct of the war in Iraq. Should the US withdraw the Gulf states might find themselves once again under pressure from their bigger, poorer neighbors, Iraq and Iran. But if the Gulf regimes need the US the opposite is just as true. America needs a stable source of oil for itself and the world, and US companies want to increase an already booming trade with the Mideast. The indirect but powerful role these oil states play in financing the U.S. deficit further enmeshes Washington's interests with the region's, no matter how contentious relations may get over America's foreign policy.

The authoritarian governments in the Gulf will have to change to keep pace with their wealthy, better-educated populations. While more money in people's pockets buys time, the rulers are facing demands for accountability and wider political participation. Some think oil money could have negative consequences since, with financial pressure off, governments may delay reform.

Yet it doesn't look like this Gulf boom will fizzle soon, since oil is in such demand: Econbrowser has a useful discussion here. One possible scenario: As global interest rates rise with the recovery of Japan and Europe, worldwide competition for capital will heat up, and the well-heeled investors of the Gulf will become even more iimportant players in financial markets.

2 comments:

I don’t think that the debate is necessarily about withdrawal from Iraq. The issue is should we* stop trusting the group of individuals that got us into this mess. This group got it wrong in Iraq, Palestinian territories, Lebanon, Egypt, Syria, and Iran. How can we* be confident that they will get us* out of the mess? Do we* really trust a person like Bliar who receives messages from God? Does Howard also have meetings with God?

Now concerning withdrawal. This is a non-issue. It has been clear since the invasion of Iraq that it is in the strategic interest of both friend and foe to have an ongoing and indefinite US military presence in Iraq that is bogged down by a low intensity insurgency. Stay in Iraq, after all no one wants withdrawal, not even that bearded nut who also talks to God.

* we, us: in this context mean we and us, respectively, in contrast to them

(clarification for the Cronulla mob.)

Rabee, I think your comment might have ended up in the wrong place but happy to respond here.

My impression, contrary to your claims, is that the US is intent on deserting Iraq - and that is the problem particularly for Sunni but also generally for non-fanatical muslims in Iraq.

Maybe you have heard the debate now starting in the US that 'civil war' would be healthy for Iraq. Maybe you have seen George Bush's clear statements that the US will not intervene to prevent sectarian violence.

Bush may have got it wrong going into Iraq (as an initial supporter of intervention this applies to me as well) but it seems to me wrong of him to wash his hands of a mess he helped to create.

Iraq urgently needs a non-sectarian govt/police and the scope for investment to occur. It cannot when violence is widespread and the society is on the verge of collapsing into all-out civil war.

How about a barbie at Cronulla when you come back to visit?

Post a Comment